Introduction To Game Design Matthew

Markstrat Tips: Introduction | How to Win Markstrat (2018)

![]()

Markstrat is a marketing strategy simulation used by over 500 academic institutions in undergraduate and MBA programs.

In Markstrat, the marketing plan that you make early on will have a strong influence on how well your team does throughout the game, so it's good to be prepared before you start.

To help you out, I've begun writing a Markstrat Ti p s series. The entire series will go over the basics of Markstrat, the 'best practices' for each decision type, a period-by-period strategy that you can follow, and a look at the decisions (successes and mistakes) that my team made to come first place in our simulation.

In this blog: Introduction to Markstrat & Entry-Level Tips

Introduction to Markstrat

For a full overview of the game, I'd recommend reading or at least skimming through the Markstrat manual. Here are the basics…

In Markstrat, your team will compete against other teams for market share in the Sonite and Vodite markets. Sonites and Vodites are fictional products made up of different physical attributes, such as: features, design, battery, display, power, price. These attributes are delivered in scales, for example: battery (hours) is on a scale of 24–96; display (inches) is on scale of 4–40. In each market, different consumer segments will prefer different variations of those attributes (like low-end and high-end consumer segments in real life). In the first round your team will automatically start with 2 Sonite products; you can then launch new brands or enter the Vodite market in later periods.

To win, your team will need to end the game with the highest net contribution margin or share price index (depending on professor/admin preferences).

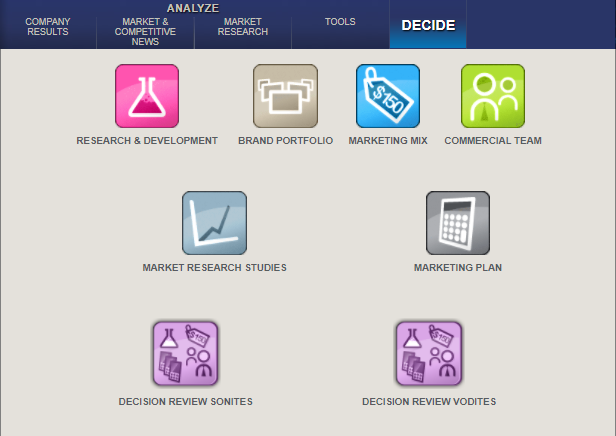

The simulation will usually run around 8 periods. In each period, your team will need to make decisions in the following areas:

- Market Research

- Marketing Mix (advertising, production planning, pricing)

- Commercial Team

- Brand Portfolio (launch, drop, or modify brands)

- Research and Development (build the underlying product for your brands)

I am currently writing posts to cover each type of decision above, which will be linked in this article and posted on my website. You can also click on my name/profile above or below this article and follow me on Medium to keep up-to-date when I post. For now, we'll keep those decision areas above in mind and look at the entry-level Markstrat tips below.

Entry-Level Markstrat Tips

- Always spend your entire budget in the beginning periods. In the beginning periods, it is common to see all teams receive a fixed and equal budget. This ensures that the game is as fair as possible, as some teams will start off in better positions than others. Because the budget is fixed to a set amount each period, any leftover budget will not carry over to the next period. Your focus in the beginning should also be to gain as much market share as possible; this is not the time to begin cutting down margins. In the later periods your budget will be determined by your performance in the previous round, and budget surpluses will carry over into the next period. If you're doing well, you may find that you have more budget in a single period than you need for advertising and commercial team (you can see this in the Experiments market research reports, which show expected change in contribution had you increased your ad/commercial team spend). The fight for market share should be pretty much over by these periods, and the new focus is maximizing your net margin; if increasing advertising or commercial team spend is going to decrease your net margins, don't do it, let it carry over.

- Focus on the ideal points. This is probably the most basic but important Markstrat tip. In your Semantic Scales market research report, you will see each target segment's "ideal point" on positioning maps laid out by price and each other physical attribute. You will also see where each brand on the market lands on this map. This is showing you what each segment wants and how well they perceive each brand at delivering it. Unless you have no competitors on a segment (meaning you can charge higher prices or not deliver a perfect product and still get sales), you want each of your brands to stay as close to its target segment's ideal point as possible. These points will move each period, typically in a pretty linear trajectory (click "access additional charts" at the bottom of your Semantic Scales report), so make sure to track this and forecast ahead when building new base projects in R&D.

- Find out what is most important to your segment. Segments place higher value on certain product attributes than others. Typically this is Power and Price for Sonite segments, Connectivity and Price for Vodite segments (you can see this in the Conjoint Analysis report). When trying to hit a segment's ideal point, focus on the positioning map that plots those two most important characteristics. Every period when you advertise your brands, set perceptual objectives for these two characteristics to try and bring your brand closer to that point.

- Don't underproduce in the beginning periods. The beginning periods are all about gaining market share. There is much more harm in selling out (losing potential sales and share) early on than incurring inventory costs, especially if your budget is fixed for the next period (i.e. EI costs won't be deducted from your next period budget).

- Use your market research reports. You want to make this as little of a guessing game as possible. Use your market research reports to learn what your competitors are doing: how much they're spending on advertising and commercial team per brand, which segments they are or will be targeting, when they're investing in R&D, and so forth. You'll also need market research to learn about your segments and measure the results of your decisions. There's a lot of data, so spend the first period or so familiarizing yourself with each report so you know what to look for moving forward.

- Don't be afraid to drop under-performing brands (and do it as early as possible). If you have a brand that comes in far off the ideal point and is not being received well by your target segment, it will be very hard (and take lots of money) to change those perceptions and gain market share with that brand. It is much easier to drop the brand and launch a new one; if you give the new brand lots of advertising money, market share can be gained relatively quickly in the early rounds. One of the best decisions our team made was to drop one of our beginning brands very early on in the game (LOCK) and focus on the higher end segments where we had a good product (LOOP) to base new brands off of.

- First impressions matter. As mentioned in the previous point, it can be hard to change the initial perception that a brand receives on the market. If the brands that you start with are far off the ideal point of the segments you wish to target, it may be better to wait until you have new base projects created before you launch new brands. If you launch a brand and it is far off the ideal point, take it off the market and try again with different perceptual objectives or wait until you have a better base project. Brands that come on the market earlier than others, but are far from the ideal point, will capture much less market share (both short-term and long-term) than brands which come in a period later and hit the ideal point perfectly.

- Use perceptual objectives. The "base project" of a brand determines its physical attributes; a perceptual objective determines what you want your target segment to perceive each physical attribute as. Because segments' ideal points are always moving, you base project will not always deliver exactly what they are asking for. Use perceptual objectives to bring your brand closer to the ideal point each period. For example, if your brand is perceived as a 3.0 in power on the Semantic Scales chart and the segment's ideal point for power will be a 3.2, you can set your perceptual objective to 3.4 to land directly on the ideal point. As a note, never use perceptual objectives to make a segment perceive your price as higher (some teams made the mistake of doing this); if the ideal point is moving towards higher prices, just raise your actual prices so you can increase your margins.

- Don't skimp on advertising research. In order for your perceptual objectives to work, you need to spend at least 10–15% of your advertising budget per brand on advertising research.

- Out-spend your competitors in advertising and commercial team. If your brand is perceived as being close to a segment's ideal point, this is the biggest determinant of market share. Throughout my simulation, it was common to see teams leapfrog others in market share based on one round of outspending them in advertising. In the early periods (when brand awareness is low) advertising seemed to be a little more important, but as the game moved forward it became evident that having a higher commercial team helped to increase our sales and net contribution. Early on we gave our commercial team about 20% of our marketing spend (ads + commercial); in later rounds as budget increased we made it 50/50. Pay attention to your Experiments report to see where you should be spending more money.

- Give heavier advertising to your high-performing brands. Look at which brands are generating the most unit sales and the highest per unit contribution margins. Brands with high unit sales have a good opportunity to become the market leaders in their segments, support them with lots of advertising power to keep them on top of the competition (if they have slim margins, you can focus on improving these later by minimizing costs through R&D or increasing prices through price setting and perceptual objectives). For brands with good unit contributions margins, focus on trying to maximize their sales, as each dollar spent here will go a longer way for your overall net marketing contribution. In the first period, we split our budget in terms of how much net contribution each brand gave us (LOOP generated 75% of our net contribution, so it got 75% of our budget).

- Try to target maximum 2 (maybe 3) segments in Sonites. You can launch a maximum of 5 Sonite brands and 5 Vodite brands. In Markstrat, think of a "brand" as the packaging of a product, and the "base project" as what is actually inside. You will typically need a different base project to target different segments, but multiple brands can use the same base project. Limiting yourself to two segments means that you can limit yourself to two base projects, which will save costs. This is because the more units you sell of each base project, the lower your "transfer costs" (cost of production). This is also because it will cost you a good amount of money each time you want to create a new base project through R&D, therefore you don't want to have too many. With those two base projects, you can then launch 5 brands in the Sonites market. This will spread your advertising, but allow you to capture as much market share in each target segment as possible.

- Plan your long-term strategy (Sonites and Vodites) in Period 1. Decide where you want to be by the final period, and then set a period-by-period strategy to get there. Knowing when you plan to invest in R&D and when (if) you plan to enter the Vodite market will help you organize your spending each period. Spend a good amount of time looking at the data you have in Period 1 to do this, and choose target segments wisely (based on size, price-sensitivity, competition, etc.).

Additional Resources

As mentioned, I am currently writing separate articles to go over Markstrat tips for each decision area, to give a suggested Markstrat marketing plan, and to show the period-by-period decisions that my team made to win Markstrat and to help you learn from our successes and mistakes.

To keep up-to-date on when those articles are released, you can follow my Medium account, or connect with me on LinkedIn.

If you have any specific questions in the meantime, please feel free to leave a comment below or contact me here — I'd be more than happy to help.

For more articles on brand management and digital marketing, feel free to check out my website.

Introduction To Game Design Matthew

Source: https://medium.com/@matthew.fernandez/markstrat-tips-introduction-how-to-win-markstrat-2018-beed406a8d05

Posted by: townepelvery.blogspot.com

0 Response to "Introduction To Game Design Matthew"

Post a Comment